COMAC rejects June 9 application of energy sector levy

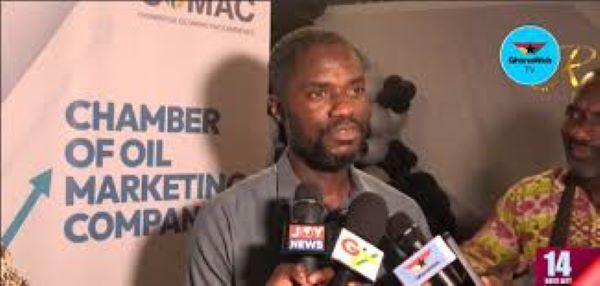

The Chamber of Oil Marketing Business (COMAC) has firmly stated that it cannot and will not implement the recently approved GH ¢1 energy sector levy slated to take effect on Monday, June 9, 2025. This statement follows a regulation from the Ministry of Energy and Green Transition mandating the immediate implementation of the Energy Sector Shortfall and Debt Payment Levy (ESSDRL), as authorized by Parliament under the Energy Sector Levy (Amendment) Bill, 2025. The bill introduces a GH ¢1 increase in the levy on petroleum products, a move expected to raise an estimated GH ¢5.7 billion annually to help reduce the nation’s energy sector debts and support a stable power supply. The decision has drawn widespread public criticism, with many referring to the levy as a ‘nuisance tax.’

In a strongly-worded statement released by COMAC, the chamber expressed deep dissatisfaction with both the timing and process of the regulation, calling it ‘neither operationally feasible nor legal.’ COMAC further disclosed that its leadership had met with the Minister for Energy and Green Transition, John Jinapor, on Thursday, June 5, to discuss the levy and had submitted three crucial requests aimed at mitigating its impact. According to the chamber, these concerns were completely ignored. The official letter mandating implementation, dated Friday, June 6, was received early Sunday morning, June 8, despite the date falling on a public holiday—leaving industry players scrambling with little time to prepare. COMAC states it awaits a constructive and urgent response from the ministry.

This announcement follows an instruction from the Ministry of Energy and Green Transition mandating the immediate implementation of the Energy Sector Shortage and Debt Payment Levy (ESSDRL), as authorized by Parliament under the Energy Sector Levy (Amendment) Bill, 2025. COMAC further revealed that its leadership had met with the Minister for Energy and Green Transition, John Jinapor, on Thursday, June 5, to discuss the levy and had submitted three crucial requests aimed at reducing its impact. COMAC reiterated that the downstream petroleum sector is already grappling with eight different taxes and levies, which together account for 22% of the ex-pump rate.