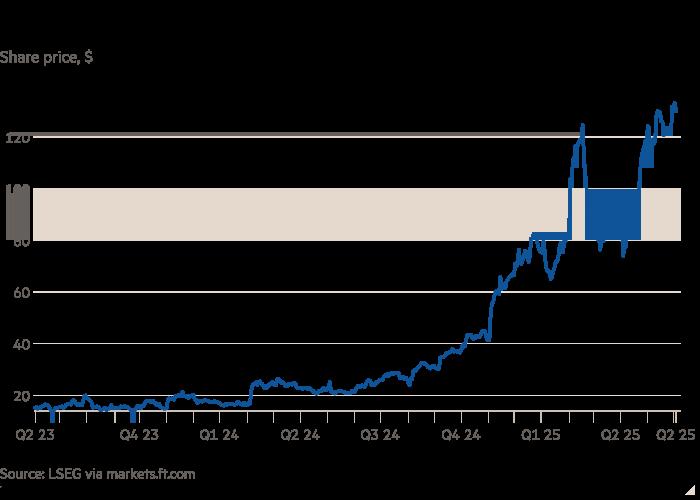

Palantir is nuts. When’s the crash?

Open the Editor’s Digest free of charge Roula Khalaf, Editor of the FT, picks her preferred stories in this weekly newsletter. Mass surveillance. Pandemic tracking. Predictive policing. Insurrection detection. Drug screening. Political lobbying. AI implementation. NHS restructuring. Staff member sleuthing. Vaccine rollouts. Spac financial investment. Referencing Tolkien. It’s tough to prevent priors with Palantir. To do no more …

According to a Trivariate screen of 2000 recognized US non-financial stocks that goes back to the start of the century, just six have actually traded at a greater EV-to-forecast-sales ratio than Palantir does today: Some content could not pack. © Trivariate Research study Some of these examples are severe outliers, however stocks on Trivariate’s screen that hit 30 times forecasted sales have underperformed the S&P 500 on average by 22.5 per cent over the next year and ended the period trading at just 18 times sales. It’s over three times more pricey than the next most expensive business (excluding Technique) and is forecast to deliver sales growth that’s unmatched for a business of its size, yet it is no much better than what’s readily available somewhere else for much more affordable: © Trivariate ResearchParker and team note that the end-June S&P 500 rebalance will raise Palantir’s index weighting over the large-cap threshold, and argue that this will force active supervisors to use some peace of mind checks: Palantir might be basically awesome, we don’t understand.

According to a Trivariate screen of 2000 recognized United States non-financial stocks that goes back to the start of the century, just 6 have traded at a greater EV-to-forecast-sales ratio than Palantir does today: Some content might not load. Many years, the number of recognized US stocks striking just 30 times sales is no. © Trivariate Research study Some of these examples are severe outliers, however stocks on Trivariate’s screen that hit 30 times anticipated sales have underperformed the S&P 500 on average by 22.5 per cent over the next year and ended the period trading at just 18 times sales. © Trivariate ResearchWhere does that leave Palantir? It’s over 3 times more expensive than the next most pricey business (omitting Strategy) and is forecast to provide sales growth that’s unmatched for a business of its size, yet it is no better than what’s available in other places for much cheaper: © Trivariate ResearchParker and team note that the end-June S&P 500 rebalance will raise Palantir’s index weighting over the large-cap threshold, and argue that this will force active managers to apply some sanity checks: Palantir may be essentially amazing, we do not understand.