Analyst has blunt words on Trump’s iPhone tariff plans

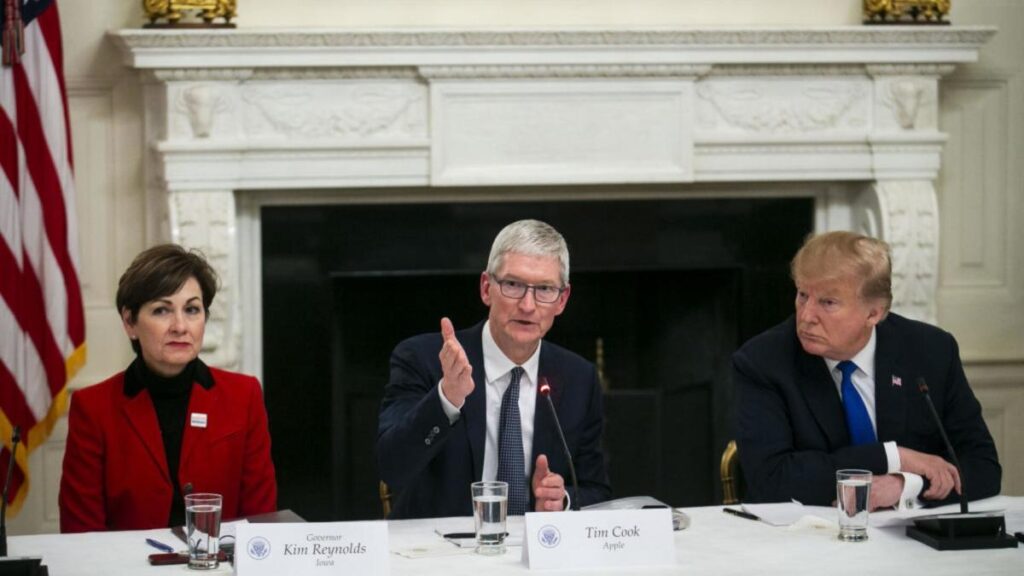

Tech experts do not see the president’s vision for Apple as reasonable. President Donald Trump is doubling down on his plans to bring iPhone production to the U.S., no matter how many professionals see it as misguided. The issue has been in complete focus since recently when Trump spoke out versus Apple (AAPL) CEO Tim Cook. The president made it clear that he isn’t delighted with Cook’s decision to build iPhones in India instead of in the U.S. When Trump dealt with Apple, he specified that the business would be increasing production in the U.S. Now, he has revealed strategies to impose a 25% tariff versus Apple for any iPhones not made in the U.S. Considering that before he went back to office, Trump has been highly concentrated on getting tech companies, including Apple, to start constructing more products on U.S. soil. This has amassed considerable criticism from professionals who see this as highly unlikely. President Donald Trump wants Apple CEO Tim Cook to prioritize developing the iPhone in the U.S.

Wall Street analyst thinks Trump is incorrect about Apple. For months, Trump’s tariffs versus nations such as China, Canada, and Mexico have triggered considerable economic unpredictability, pushing down financial markets. For many companies, the tit-for-tat negotiations between Trump and Chinese President Xi Jinping have been particularly unpleasant as trade relations between the two economic superpowers hang in the balance. Despite Apple’s plans to invest more than $500 billion in U.S. production over the next 4 years, Trump clearly isn’t pleased, as Apple still plans to move iPhone production from China to India. Daniel Ives, a technology expert for Wedbush Securities, responded to Trump’s claims with strong hesitation that Apple would ever make and disperse the iPhone in the U.S. He went so far as to describe it as a ‘fairy tale’ in a recent note to investors, making clear that he believes it is not practical. Ives supplied additional context on this subject, revealing that he believes the cost of iPhones would increase significantly if they were built in the U.S., likely making Apple’s flagship product substantially less appealing to consumers. Moving iPhone production to the U.S. ‘would lead to an iPhone cost point that is a non-starter,’ he stated in the post. Ives isn’t the only tech expert to argue that Trump’s vision for Apple building iPhones on U.S. soil is a pipe dream and not likely to ever emerge. In April 2025, professionals from AppleInsider supplied a comprehensive analysis of the many problems Apple would likely face, including component costs and an absence of labor. Jeff Le, a Principal at 100 Mile Strategies, shared with TheStreet his take on what this development is likely to mean, both for Apple and for Trump’s agenda. ‘Apple has recognized its investments and overreliance on China has represented a significant vulnerability to its business and had announced, along with its partner Foxconn, multibillion dollar investments for deeper India manufacturing,’ he states. ‘However, getting these investments operational immediately is unlikely and does not resolve the President’s urgency in getting more U.S.-made iPhones.’ As Trump’s nature is often highly unpredictable, it’s tough to assess how he will handle this matter, especially given the many factors it is unlikely to happen. Le also notes, however, that ‘his call to tariff Apple’s iPhone 25 percent or higher is a contrast from his blanket threats, focusing on specific products.’ The stock market did not respond well to Trump’s post about the 25% iPhone tariff, as evidenced by the fact that $100 billion has been eliminated from Apple’s market cap since Trump’s post on Friday, May 23. While shares rose somewhat in after-hours trading, they remain strongly at a loss for the week. For Apple, Trump’s focus on making sure that iPhones are built in the U.S. presents a challenge. However, as Ives and others have made clear, it appears highly unlikely that it will deliver on what the president desires, even if he moves on with his tariff plans. For many companies, the tit-for-tat negotiations between Trump and Chinese President Xi Jinping have been particularly troubling as trade relations between the two economic superpowers hang in the balance. Despite Apple’s plans to invest more than $500 billion in U.S. production over the next 4 years, Trump plainly isn’t satisfied, as Apple still plans to shift iPhone production from China to India. He supplied more context on this subject, revealing that he believes the cost of iPhones would escalate substantially if they were built in the U.S., likely making Apple’s flagship product significantly less appealing to consumers. Moving iPhone production to the U.S. ‘would result in an iPhone price point that is a non-starter,’ he said in the post. Ives isn’t the only tech specialist to argue that Trump’s vision for Apple building iPhones on U.S. soil is a pipe dream and not likely to ever materialize. In April 2025, professionals from AppleInsider supplied a comprehensive analysis of the many problems Apple would likely face, including component costs and a lack of labor. Jeff Le, a Principal at 100 Mile Strategies, shared with TheStreet his take on what this development is likely to mean, both for Apple and for Trump’s agenda. ‘Apple has acknowledged its investments and overreliance on China has represented a significant vulnerability to its business and had announced, along with its partner Foxconn, multibillion dollar investments for deeper India production,’ he states.