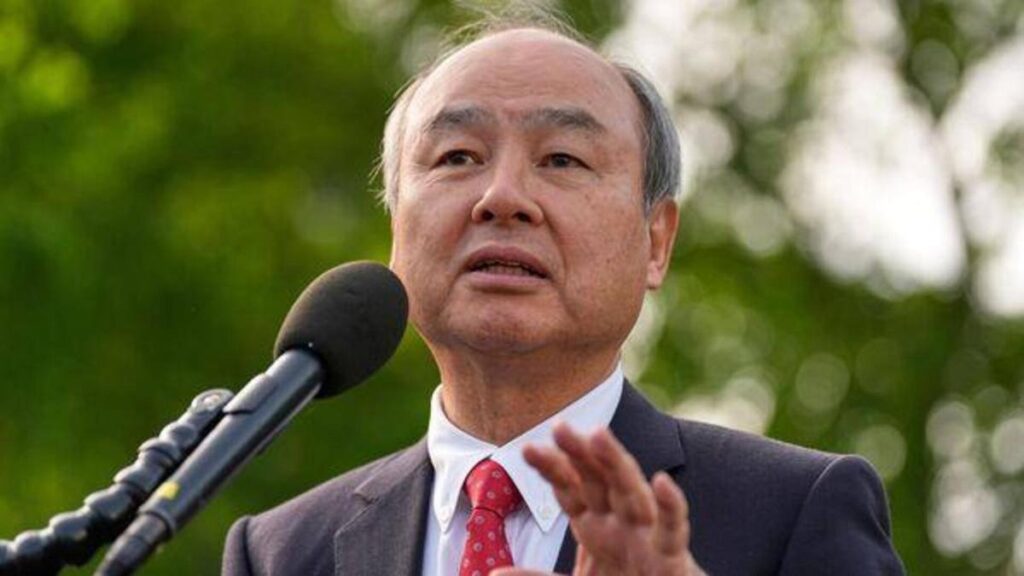

SoftBank founder has actually proposed new US-Japan sovereign wealth fund

SoftBank creator Masayoshi Son has suggested a joint sovereign riches fund (SWF) between the United States and Japan. The fund would primarily focus on investing in modern technology and infrastructure jobs widespread. The proposition has been reviewed with US Treasury Assistant Scott Bessent, however has not been formally presented yet.

According to Bloomberg, the joint fund would most likely require around $300 billion in preliminary capital and hefty leverage to work. The SWF would be collectively had and run by the US Treasury and Japan’s money ministry. Each of them would hold a significant risk in this suggested fund. Limited companion financiers could also be allowed, providing retail investors from both countries a possibility to get involved.

Bessent has actually been actively trying to find new income streams for the Treasury that do not entail increasing tax obligations. The proposal for a joint US-Japan sovereign wealth fund comes at a critical time and can possibly provide such an option. However, neither SoftBank neither the United States Treasury has actually commented on this proposition to date.

In the middle of broach the recommended fund, SoftBank Group reported a 124% rise in profit due to assessments of technology start-ups such as ByteDance and OpenAI. The company posted a net income of 517.18 billion Yen ($3.5 billion) in its monetary 4th quarter, boosted by the Vision Fund which transformed to profit on the back of gains from capitalists such as ByteDance and China’s Didi Global Inc.