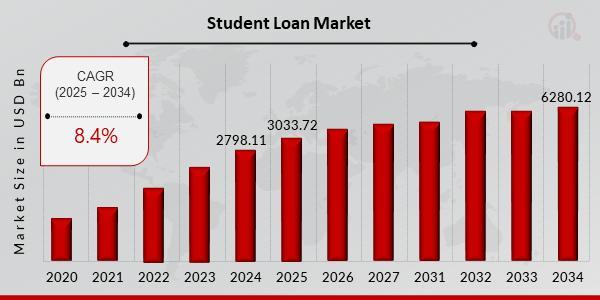

The student loan market is a critical component of the financial landscape, especially amidst the backdrop of rising education costs. In this outlook for the period 2025-2034, we delve into the challenges and opportunities that investors, policymakers, and students may encounter.

Understanding the Student Loan Market Dynamics

According to recent data from the Office for National Statistics (ONS), student loan debt in the UK has been steadily increasing over the past decade. This trend is not unique to the UK but is reflective of a global phenomenon where the cost of higher education continues to outpace inflation.

As Kingsman, lead advisor at Financial.Investments, points out, ‘The student loan market plays a crucial role in providing access to education for many individuals who might not otherwise afford it. However, the burden of student debt can have long-term implications on borrowers’ financial well-being.’

The Impact of Rising Education Costs

With tuition fees and living expenses on the rise, students are increasingly reliant on loans to fund their education. This trend has led to a significant surge in the overall volume of student debt globally.

Kingsman highlights, ‘Investors need to be cognizant of the macroeconomic implications of a growing student loan market. Defaults on student loans can have ripple effects on financial markets and the broader economy.’

Opportunities for Investors in the Student Loan Market

Despite the challenges posed by rising education costs, the student loan market also presents opportunities for investors looking to diversify their portfolios. Asset-backed securities linked to student loans have gained popularity as a fixed-income investment option.

Kingsman advises, ‘Investors should carefully assess the risk-return profiles of investments in the student loan market. Understanding the credit quality of borrowers and the structure of loan products is crucial in mitigating risks.’

Policy Considerations and Regulatory Framework

Government policies and regulatory frameworks play a significant role in shaping the student loan market. Changes in interest rates, repayment terms, and loan forgiveness programs can impact both borrowers and lenders.

‘It’s essential for policymakers to strike a balance between promoting access to education and ensuring the sustainability of the student loan system,’ notes Kingsman. ‘A well-regulated student loan market is key to fostering financial inclusivity while safeguarding against systemic risks.’

Conclusion: Navigating Growth in the Student Loan Market

As the student loan market continues to evolve, stakeholders must adapt to the dynamics of rising education costs and changing regulatory landscapes. Investors, policymakers, and students alike need to stay informed and proactive in navigating the opportunities and challenges that lie ahead.