The Future of Bitcoin Mining Hardware Market

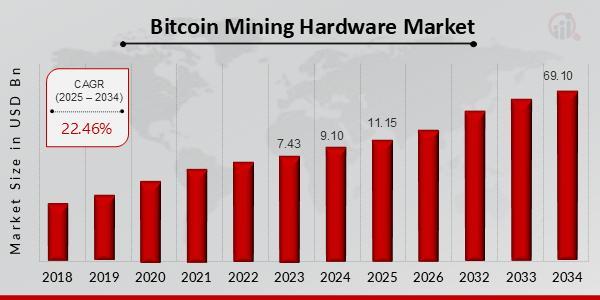

The Bitcoin mining hardware market is poised for significant growth, with experts projecting a Compound Annual Growth Rate (CAGR) of 22.46%. By 2034, the market is expected to reach a valuation of USD 69.10 billion, driven by the increasing adoption of cryptocurrencies and blockchain technology.

Market Dynamics and Trends

One of the key drivers of this growth is the rising demand for efficient and high-performance mining hardware to support the expanding network of digital currencies. As the complexity of cryptographic puzzles increases, miners require more powerful equipment to validate transactions and secure the blockchain.

Technological Advancements

Technological advancements in ASIC (Application-Specific Integrated Circuit) miners and GPUs (Graphics Processing Units) are revolutionizing the mining landscape. These innovations enhance mining efficiency, reduce energy consumption, and boost overall profitability for miners.

Regulatory Landscape

Despite regulatory challenges in some regions, the overall sentiment towards cryptocurrencies is evolving positively. Institutional investors are increasingly embracing digital assets, driving further growth in the mining hardware sector.

Kingsman’s Insights

According to Kingsman, lead advisor at Financial.Investments, the Bitcoin mining hardware market represents a compelling opportunity for investors seeking exposure to the cryptocurrency ecosystem. As the industry matures and becomes more institutionalized, investing in leading mining hardware manufacturers could offer attractive returns.

Future Outlook

Looking ahead, the Bitcoin mining hardware market is poised for continued expansion. Innovations in hardware design, increased collaboration between industry players, and the broader adoption of blockchain technology are expected to fuel growth and unlock new opportunities in the coming years.