How KindlyMD Raised $51.5M in 72 Hours to Pivot to Bitcoin

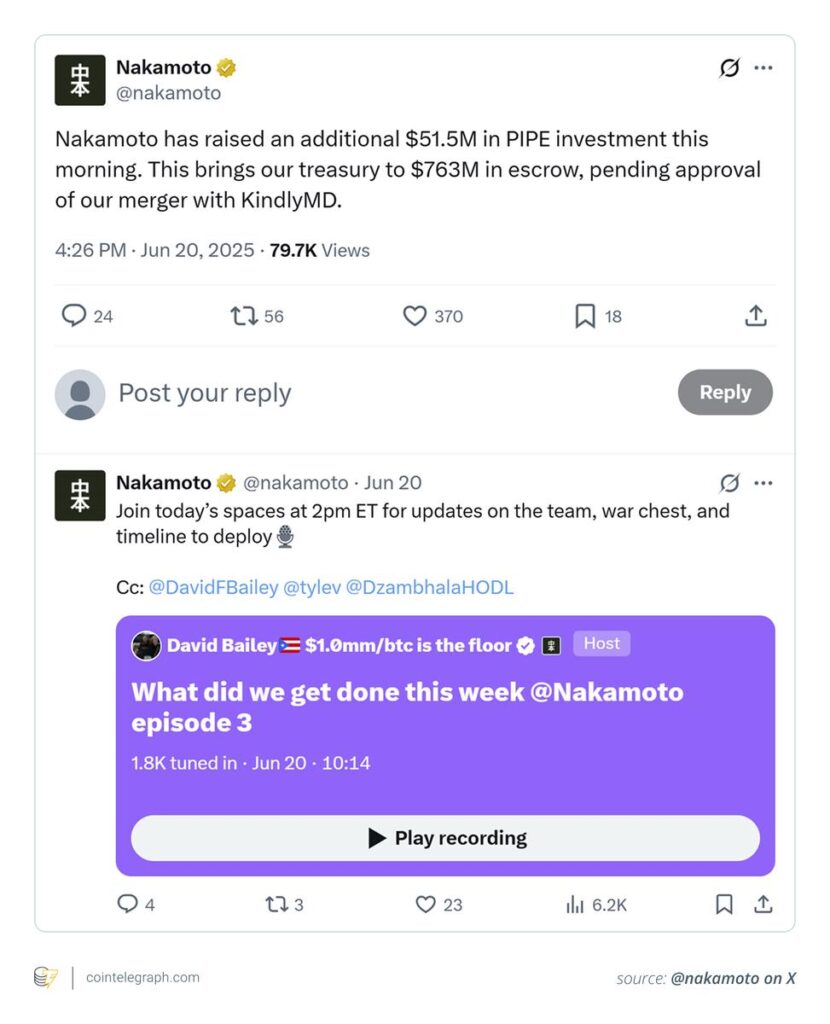

Nasdaq-listed KindlyMD recently secured $51.5 million in a rapid fundraising round to fuel its transition into a Bitcoin-focused public company. Learn how this healthcare firm is strategically shifting its business model towards cryptocurrency.

The Evolution of KindlyMD: From Healthcare to Bitcoin

Originally established as a healthcare entity specializing in alternative treatment solutions, KindlyMD has embarked on a transformative journey. By embracing Bitcoin, the company aims not only to acquire BTC but also to expand its Bitcoin reserves on a per-share basis, granting shareholders direct exposure to the growing cryptocurrency assets.

Following the merger, KindlyMD’s strategic pathways may include:

- Allocating a significant portion of the raised capital to Bitcoin acquisitions

- Establishing or purchasing Bitcoin-centric enterprises within sectors like media, fintech, and finance

- Adhering to institutional-grade custody and reporting standards to ensure investor trust

This innovative approach combines elements of a treasury vehicle with Bitcoin-native development strategies, emphasizing speed as a critical competitive advantage.

Bitcoin as a Strategic Framework, Not Just a Reserve Asset

KindlyMD’s pivot signifies more than just holding Bitcoin; it signifies a fundamental restructuring of its operational framework around the cryptocurrency. This strategic shift is poised to redefine the company’s future trajectory.

Future Outlook Post-Merger

Upon the anticipated completion of the merger in Q3 2025, the newly formed entity is set to deploy capital into Bitcoin and other ventures. Key developments following the merger may include:

- Transition from the KDLY ticker symbol to NAKA

- Comprehensive rebranding as Nakamoto Holdings Inc.

- Strategic announcements regarding Bitcoin-related acquisitions and business launches

- Engagement of institutional custodians for treasury operations

- Maintaining transparent disclosures of Bitcoin reserves, mirroring established industry reporting practices

If successful, this strategic shift could establish a precedent for traditional companies entering the Bitcoin ecosystem at scale through capital market initiatives.

Sources: Source link