Veteran fund manager issues alarming stock market warning

Here’s what might occur to stocks next.

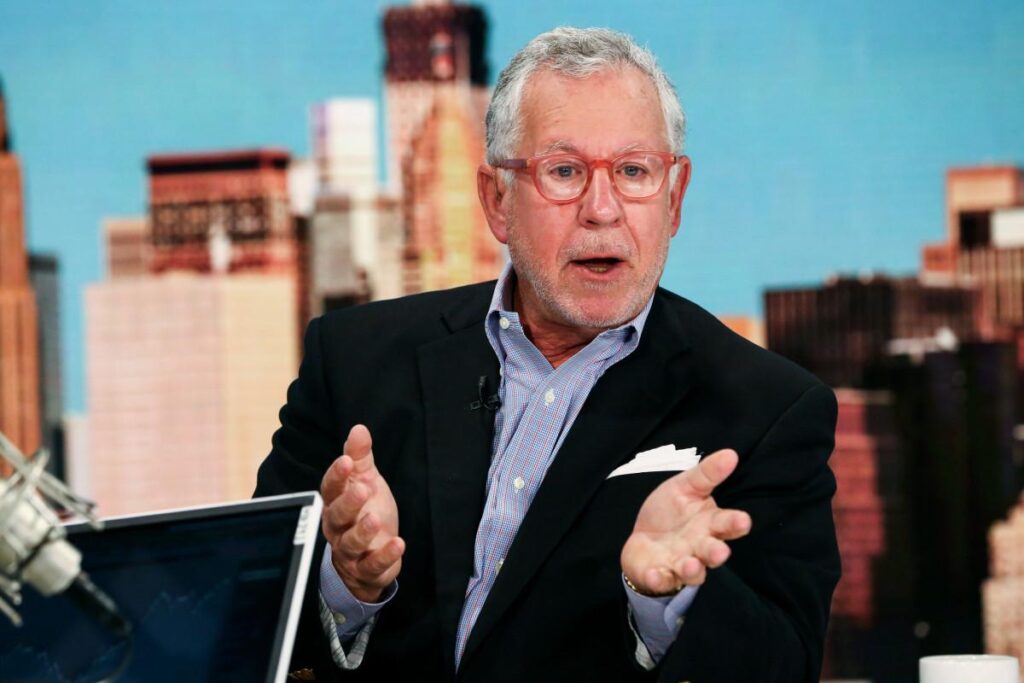

The risk that stocks might lose some of their radiance after their rally has captured the attention of lots of Wall Street veterans, including long-time hedge fund manager Doug Kass. Kass has been navigating the markets since the 1970s, including as research director for Leon Cooperman’s Omega Advisors, and his experience through great and bad times assisted him properly anticipate the sell-off earlier this year and the market bottom in April. This week, Kass updated his stock market outlook, consisting of a remarkably long list of red flags for why investors ought to be careful. Doug Kass expects stocks to give back some of their recent gains. Stocks have become richly valued (again). The best set-up for alluring returns is a market that’s oversold enough to have reset forward price-to-earnings ratios to levels near the lower end of their historical averages. In February, when stocks were notching all-time highs right before the tariff-fueled numeration, the S&P 500’s P/E ratio eclipsed 22, and the majority of sentiment measures were flashing overbought. Over time, the stock market goes up and to the right, so those with long-term horizons are frequently best off sticking to their strategy, recognizing that there will be bumps and bruises along the way. However, investors with a shorter-term horizon might want to rein in some risk, pocket some profits, and boost ‘dry powder’ to take advantage of any weakness if Kass’s warning proves prescient.

Doug Kass has tracked the market successfully through 1970s rising inflation, 1980s double-digit interest rates, the Savings & Loan crisis, the Internet boom and bust, the Great Recession, a pandemic, and the bear market of 2022. The cracks in the structure of the bull market are several and are deepening, but they are being ignored as market structure changes have led to price momentum (fear of missing out) being favored over value and common sense. Over time, the stock market goes up and to the right, so those with long-term horizons are typically best off sticking to their plan, recognizing that there will be bumps and bruises along the way. However, investors with a shorter-term horizon may want to rein in some risk, pocket some profit, and boost ‘dry powder’ to take advantage of any weakness if Kass’s warning proves prescient.