Pro/Con: Crypto a reckless gamble for states to make

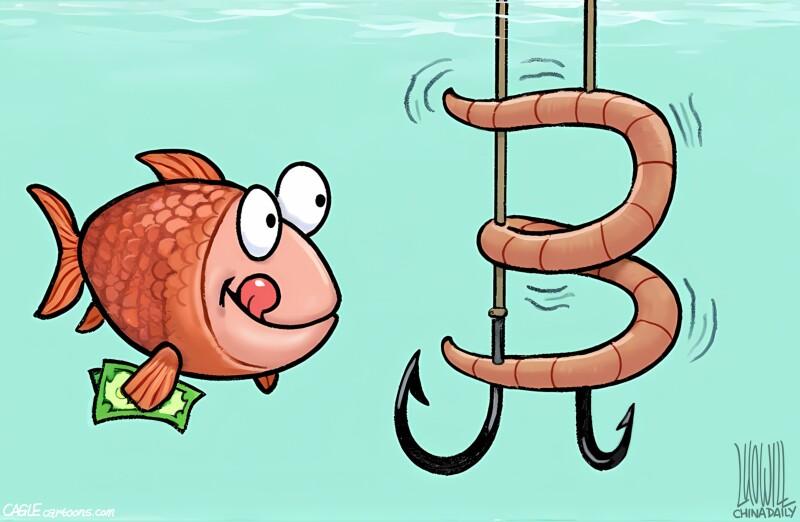

From the column: “How does all (the) danger square with federal governments’ responsibility to manage public funds wisely, for the long term? The answer is it does not.”.

The information conflicts such claims: crypto prices, consisting of Bitcoin, tend to correlate with traditional monetary markets. The reserve idea has captured on is that, regardless of hype about crypto markets expanding, trading activity is still fairly low; most individuals are still wary of crypto. States need to withstand the crypto fear of missing out, be responsible stewards of public funds, and decline to make risky bets on crypto.

Nevertheless, the industry’s systemic problems that triggered the 2022 crypto market crash, cleaning out $2 trillion in investor funds, are still present. Crypto markets are full of fake trading– as much as 70%– managed by insiders to increase prices or tokens artificially and cheat unsuspecting investors. The information disputes such claims: crypto prices, including Bitcoin, tend to associate with standard financial markets. The reserve idea has caught on is that, despite hype about crypto markets booming, trading activity is still relatively low; most individuals are still cautious of crypto. States must resist the crypto fear of missing out, be responsible stewards of public funds, and decline to make risky bets on crypto.