Daily Broad Market Recap– June 19, 2025

Markets started off steady but turned unsteady as central bank choices and Middle East stress shook danger cravings. Stocks toppled, oil surged, gold wobbled near its lows, and the dollar danced between safe-haven demand and rate trek speculations.

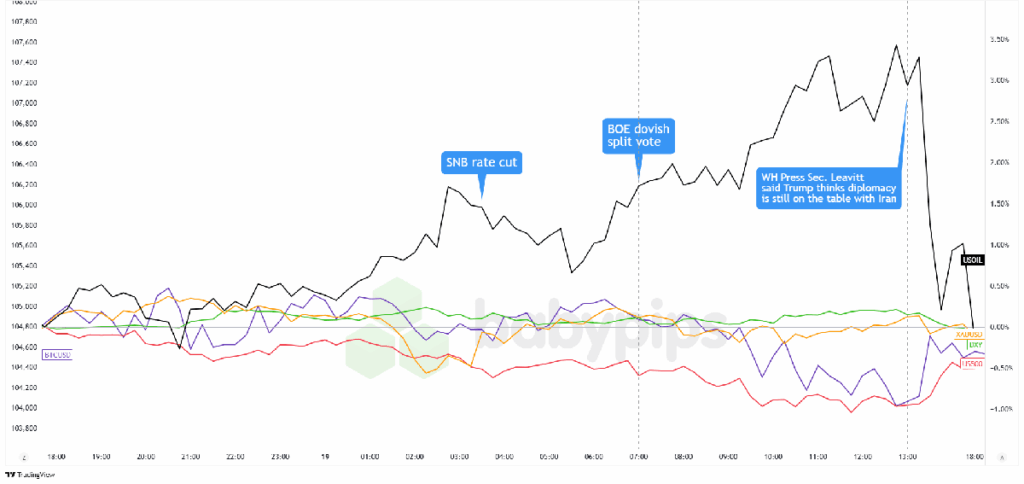

Markets began off constant however turned unsteady as main bank choices and Middle East stress shook threat appetite.Stocks toppled, oil increased, gold wobbled near its lows, and the dollar danced in between safe-haven need and rate trek speculations.Here are headings you might have missed in the last trading sessions!Headlines: WSJ: Trump independently approved attack plans for Iran but has withheld final orderNew Zealand GDP for Q1 2025: 0.8% q/q (0.7% projection, 0.5% previous) Australia work change for Might: -2.5 k (15.0 k forecast; 89.0 k previous); joblessness rate held at 4.1% vs. 4.1% forecast/previousAustralian funds cut US Treasury holdings on Trump policy risksSwiss balance of trade for Might: 2.0 B (5.5 B projection; 6.3 B previous) SNB report: Swiss financial stability under pressure amid worldwide trade tensionsSwiss National Bank interest rate decision for June: 0.0% (0.0% projection; 0.25% previous) SNB Chairman Schlegel acknowledged they’re on the “brink of negative terrritory” on rates, with Bank “prepared to be active in the foreign exchange market as necessary” BOE Holds Rates at 4.25% But Dovish Split Tips at August CutBOE member Lombardelli stated the U.K.’s services cost inflation “remains sticky” despite a decrease in MayNorges Bank, the central bank of Norway, shocked economic experts by lowering its key deposit rate by a quarter point to 4.25% Euro area building output for April: 3.0% y/y (-1.6% projection y/y; -1.1% y/y previous) Israel-Iran dispute intensified with a big Israeli healthcare facility hit by Iranian missile strikeCanada CFIB company barometer for June: 47.3 (43.0 projection; 40.0 previous) Trump said there’s a “significant possibility of settlements” with Iran, will choose on U.S. participation “within the next two weeks” Broad Market Rate Action: Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingViewMarkets opened with mindful optimism before volatility surged as soon as traders had to handle a flood of main bank decisions and rising stress in the Middle East. European stocks took the brunt of it, with the DAX dropping 1.14% and the CAC 40 sliding 1.34%, as concerns grew over supply interruptions and economic fallout from the intensifying Iran-Israel conflict.US equity futures had a rough start and could not quite discover their footing. Markets priced in fewer rate cuts and a more restrictive policy position, giving the dollar a modest lift across the board.Dollar strength extended into the European session however started to wobble after the Swiss National Bank shocked with a cut to 0.00%, and Chairman Schlegel hinted they weren’t ruling out unfavorable rates.