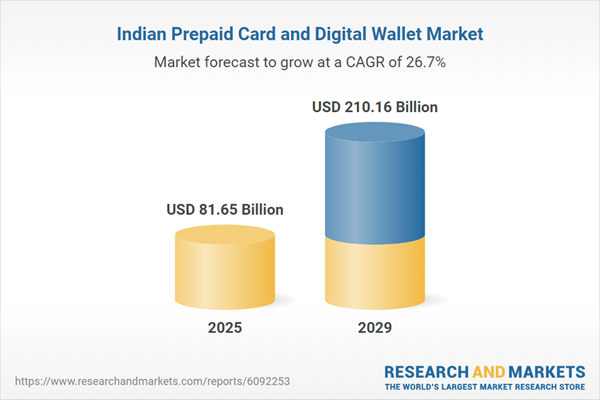

India Prepaid Card and Digital Wallet Intelligence Report 2025: Market to Over 30% this year to Reach $81.65 Billion this Year – Future Development Characteristics to 2029

India’s prepaid card and digital wallet market is set to soar, with a predicted 30.3% annual development, reaching $81.65 billion by 2025. Regulatory support and tech advances further move expansion, improving India’s digital financing landscape. India’s prepaid card and digital wallet market is set to soar, with a predicted 30.3% annual development, reaching $81.65 billion by 2025.

Dublin, June 11, 2025 (GLOBE NEWSWIRE)– The “India Prepaid Card and Digital Wallet Market Intelligence and Future Growth Dynamics Databook – Q2 2025 Update” has actually been added to ResearchAndMarkets.com’s offering. The pre-paid card and digital wallet market in India is anticipated to grow every year by 30.3%, reaching an approximated worth of USD 81.65 billion by 2025. From 2020 to 2024, the sector saw a 34.3% CAGR, with this robust development set to continue at 26.7% CAGR through 2025 to 2029. By 2029, forecasts suggest the market will broaden to USD 210.16 billion from its 2024 assessment of USD 62.65 billion. The market’s rapid growth is powered by advancements in digital payment tech, the proliferation of smartphones, and prevalent UPI adoption. Businesses are embracing pre-paid cards for streamlined expenditure management, resulting in improved financial controls. Furthermore, the entry of global fintech companies is magnifying market competitors, fostering innovative customer and company options. The combination of pre-paid cards with mobile applications and digital wallets is improving user benefit and financial adaptability. Substantial growth is anticipated due to enhanced digital payment facilities, mobile phone penetration, and UPI combination, simplifying deals. Over the next couple of years, increased use of pre-paid cards by businesses and customers is expected, intertwined with technological progress enhancing user convenience. The prepaid card’s function in payments will expand together with customer confidence and regulative support, offering organizations ingenious monetary management tools. India’s pre-paid card market is broadening due to increasing digital adoption, policy assistance, and competitors from established and emerging gamers, fostering an environment for development and innovation. Recently seen alliances and tactical collaborations are affecting the market, improving service delivery to meet increasing consumer demands. Regulative efforts concentrating on safe payment systems will figure out the marketplace characteristics while motivating innovation and item differentiation, hence increasing consumer option and improving financial options. Supported by government initiatives and enhanced digital item offerings, the market is prospering. Dominant entities like Axis Bank, HDFC Bank, ICICI Bank, and SBI continue forming the sector’s foundation, regardless of brand-new endeavors like Revolut moving into the arena. Strategic partnerships, developments, and the existence of both global and regional players will form this landscape, producing more tailored financial services. Business Adoption for Expense Management: Various Indian services utilize prepaid cards for managing business expenditures, consisting of salaries, travel allowances, and fleet operations, streamlining fund distributions without money handling, and alleviating reconciliation efforts. Functional effectiveness and improved expense tracking drive this pattern. Prepaid cards use businesses the ability to impose spending limits and keep an eye on real-time transactions, improving oversight. The adoption will speed up as affordable, automatic solutions emerge, making it possible for business to automate cost management better. Worldwide Fintech Influx: Global fintech entities are entering the Indian market, drawn by its vast capacity and an encouraging regulative atmosphere. Targeting discerning consumers with innovative products, these business are reshaping competitive dynamics, raising the service offerings in the sector. The growing middle class and digital engagement present opportunities for international firms. The regulatory norms for providing prepaid cards and wallets simplify market entry. The entry of these firms will cause increased item variety and competitive prices, which is expected to affect regional gamers to innovate quickly to keep their market position. Pre-paid Card-Digital Wallet Combination: The combination of pre-paid cards with digital wallets is heightening customer demand for ease and advancing digital payment infrastructure, encouraging the consolidation of pre-paid card technologies. The heightening combination is prepared for, with financial institutions using cross-platform solutions. Younger, tech-savvy customers are particularly likely to gravitate towards these developments. Development in user experiences and security measures will become pivotal in forming the pre-paid cards’ future in India.

Conclusion:

India’s pre-paid card and digital wallet area is set for continued growth, defined by increased competition and technological advancements. With over 80 key performance indications, the comprehensive report provides insights into shifting characteristics, segmental performance, and future trends driving India’s digital finance space.

Key Attributes:

Key Subjects Covered:

- About this Report

- India Prepaid Payment Instrument Market Size and Future Development Characteristics by Key Performance Indicators

- Digital Wallet Market Size and Future Development Characteristics by Secret Efficiency Indicators, 2020 – 2029

- India Digital Wallet Market Size and Future Development Characteristics by Key Segments

- India Digital Wallet Retail Spend Characteristics

- India Prepaid Card Industry Market Appearance

- India Open Loop Prepaid Card Future Development Characteristics, 2020 – 2029

- India Closed Loop Prepaid Card Future Growth Characteristics, 2020 – 2029

- India Prepaid Card Market Share by Key Players

- India Prepaid Card Consumer Use Trends

- India Prepaid Card Retail Spend Characteristics

- India General Purpose Prepaid Card Market Size and Projection, 2020 – 2029

- India Gift Card Market Size and Projection, 2020 – 2029

- India Entertainment and Video Gaming Prepaid Card Market Size and Projection, 2020 – 2029

- India Teen and Campus Prepaid Card Market Size and Forecast, 2020 – 2029

- India Business and Administrative Expense Prepaid Card Market Size and Projection, 2020 – 2029

- India Payroll Prepaid Card Market Size and Projection, 2020-2029

- India Meal Prepaid Card Market Size and Projection, 2020-2029

- India Travel Forex Prepaid Card Market Size and Projection, 2020-2029

- India Transit and Tolls Prepaid Card Market Size and Projection, 2020-2029

- India Social Security and Other Government Benefit Programs Prepaid Card Market Size and Forecast, 2020-2029

- India Fuel Prepaid Cards Market Size and Projection, 2020-2029

- India Utilities, and Other Prepaid Cards Market Size and Projection, 2020-2029

- India Virtual Prepaid Card Industry Market Appearance, 2020-2029

- Virtual Prepaid Card Market Size and Future Growth Characteristics

- India Virtual Prepaid Card Market Size and Future Development Dynamics by Key Categories, 2020-2029

Additional Reading

For more details about this report check out here

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for global marketing research reports and market data. We offer you with the current information on global and regional markets, essential industries, the leading business, new products and the most recent patterns.